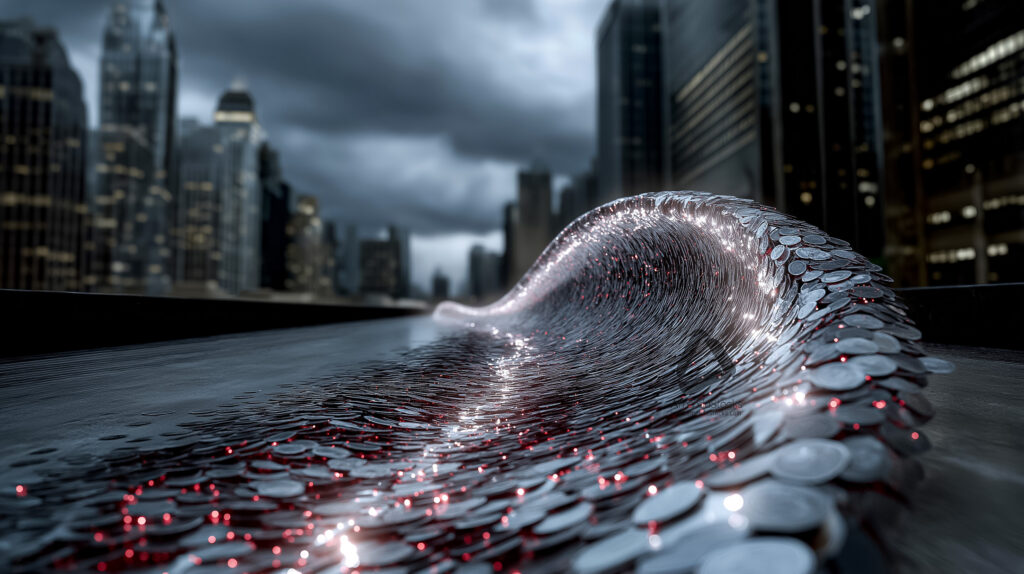

If you’re reading this, chances are you either lost money in the recent crypto meltdown or you’re trying to figure out what the hell just happened. Trust me, you’re not alone. Over 1.6 million traders got liquidated, and more than $19 billion vanished faster than you can say “Bitcoin to the moon.” Lets check the crypto market crash 2025.

So was this the end of crypto? Or just another painful reset before things get better? Let’s break it down.

When Everything Went Wrong

It all started on October 10. Bitcoin was flying high—we’re talking fresh all-time highs above $126,000. Everyone was feeling bullish. Leverage was through the roof. People were taking out loans to buy more crypto. Classic bull market stuff.

Then China dropped a bomb.

They announced new restrictions on exporting rare earth minerals—the stuff that basically makes all our tech work. Within hours, Trump fired back on social media, threatening massive tariffs on Chinese goods. And then he doubled down with a 100% tariff announcement on ALL Chinese imports.

The market absolutely lost its mind.

Bitcoin dropped $3,000 almost immediately. Then it kept falling. By the end of the day, it had crashed $20,000. The VIX—that fear gauge everyone watches—shot up 32%. People were panicking.

The Domino Effect That Made Everything Worse

Here’s where things got really ugly. The market was already sitting on over $94 billion in Bitcoin open interest—basically record levels of leverage. When prices started dropping, exchanges automatically liquidated long positions. This triggered more sell-offs, which triggered more liquidations, which triggered more sell-offs.

It was a death spiral.

And it happened at the worst possible time—late Friday afternoon when traditional markets were closing and liquidity was already thin. To make matters worse, major exchanges like Binance, Coinbase, and Robinhood started glitching. Order books froze. Stop-losses didn’t trigger. What should have been a sharp correction turned into total chaos.

In less than 24 hours, $19.1 billion in leveraged positions were wiped out. For context, the COVID crash only liquidated $1.2 billion. The FTX collapse? $1.6 billion. This was on another level entirely.

Was Someone Playing Both Sides?

Here’s where things get sketchy. Blockchain sleuths noticed something interesting—a whale wallet on Hyperliquid made some suspiciously well-timed short trades. This person made nearly $200 million by betting against the market right before Trump’s announcements.

And get this—they doubled down just 30 minutes before Trump’s second major tweet.

Could be lucky timing. Could be insider information. Nobody knows for sure, but crypto lawyers are already calling for investigations. When politics and crypto collide, the line between smart trading and manipulation gets pretty blurry.

So… Is Crypto Dead?

Not even close.

After Bitcoin dropped below $12,000, it bounced back hard. Within days, it was hovering between $110,000 and $113,000. The rebound suggests this was mostly a leverage flush—not a fundamental breakdown in crypto’s value proposition.

And the smart money? They were buying. BlackRock’s ETF reportedly scooped up over 21,000 BTC during the chaos. Major XRP holders added billions of tokens. When the weak hands panic sell, the institutions quietly accumulate. Tale as old as time.

What About Altcoins?

This is trickier. While Bitcoin recovered relatively quickly, altcoins got absolutely hammered. Ethereum, XRP, Solana, Dogecoin—they all dropped 20-40% or more. The altcoin season index fell to 55, well below the 75 threshold that typically signals explosive growth.

The days of “everything pumps” might be over. Going forward, altcoin rallies will probably be more selective. Winners will likely be projects with real narratives—AI integration, real-world assets, ETF approvals. The garbage coins? They might not come back.

What Happens Next?

Honestly? Nobody knows. And anyone who tells you they do is lying.

Trump set a November 1 deadline for his new tariffs, with a major summit scheduled for October 31. If negotiations go well and tensions ease, we could see a massive relief rally. If things get worse, the pain might continue.

The market’s basically being controlled by headlines right now. Every tweet, every news story, every rumor can move prices significantly. It’s exhausting, but that’s where we are.

What Should You Do?

Look, I’m not a financial advisor, but here’s what seems clear:

The structural reasons for crypto’s bull market are still intact. Institutions are accumulating. Fundamentals are solid. The over-leveraged gamblers got flushed out, which is actually healthy long-term.

But volatility is here to stay. If you’re in crypto, you need to accept that wild swings are part of the game. Pay attention to global news. Don’t use leverage you can’t afford to lose. And maybe don’t check your portfolio every five minutes—it’s bad for your mental health.

Bitcoin remains the safest bet if you’re conservative. Altcoins might offer bigger returns, but they come with bigger risks. And for the love of everything holy, make sure you’re using exchanges that won’t crash when you need them most.

The Bottom Line

The October 2025 crypto crash was brutal. Billions were lost. Millions of traders got rekt. But crashes like this have happened before, and they’ll happen again.

The bull market isn’t dead—it’s just evolved. The rules have changed. This isn’t 2021 where you could throw money at any random coin and make a fortune. You need to be smarter, more selective, and more resilient.

Crypto is still the Wild West. It’s thrilling, terrifying, and absolutely unpredictable. If you can handle the volatility and stay informed, there’s still massive opportunity here.

Just maybe keep some cash on the sidelines for the next time things go sideways. Because they will.